Will Your Wealth Unify or Divide Your Family?

Will Your Wealth Unify or Divide Your Family?

By Amy A. Castoro

If you’re like many successful Baby Boomers, you’ve come to think of your wealth as money, stocks, bonds and real property.

If you’re like many successful Baby Boomers, you’ve come to think of your wealth as money, stocks, bonds and real property.

But family wealth is much more than tangible financial assets. Family wealth also includes your family’s name, reputation, and values. It also includes your family’s history, experience, and education, as well as its intellectual, social and networking capacity, not to mention reputation.

As most families come to know, a family’s most valued assets are the unity and harmony of its members—parents, children, grandchildren, and spouses.

When it comes to transferring your wealth to beneficiaries, how do you transfer your unity and harmony along with your financial assets? And why is this even important?

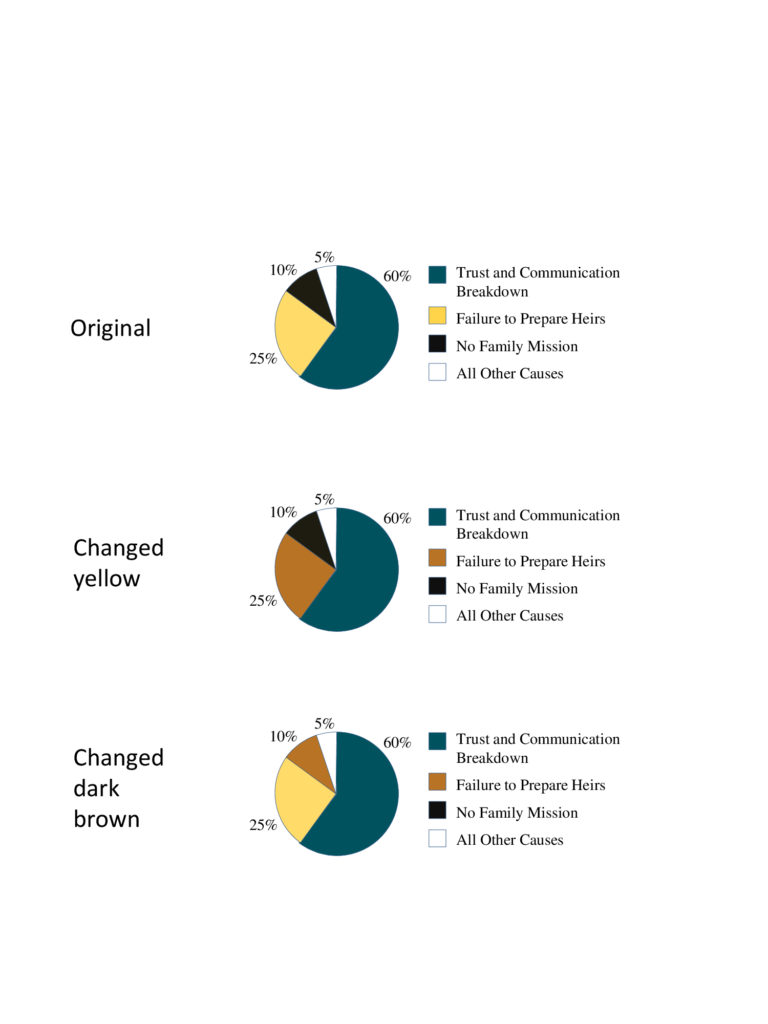

Consider this: In 70% of all wealth transfers, assets are lost and family unity is disrupted due to discord, disputes and, in some instances, litigation. An estate plan focused solely on preparing the financial assets for beneficiaries cannot guarantee lasting family unity and harmony.

Baby-Boomers are finding they need to begin to look beyond the good work being done by their estate planning attorneys, accountants and financial, tax and insurance advisors who focus on preserving financial assets while minimizing taxes. Professional advisors typically do not look within the family itself for issues that may unravel their good work once the estate transitions and beneficiaries receive their inheritances.

Why Most Estate Transitions Fail While Others Succeed

A study conducted by The Williams Group (1975 – 2001) of more than 2,000 successful families post-estate transition revealed that a lack of trust and communication among family members were the leading causes of the 70% failure rate. Most estate transition failures were not the result of missteps by the professional advisors.

Trust And Communication: The Foundation For a Unified Family

Trust is made up of three components that make successful wealth transfer possible:

- Reliability: Do you do what you say you will do and when you promised to do it?

- Sincerity: Does your private story match your public story?

- Competence: Do you have the ability, skill, and capacity to accomplish and meet commitments you make?

The above three components of trust must be present for authentic trust to exist within families. Without authentic trust, honest and effective communication cannot exist. For example, listening is an important component of effective communication. Listening requires the ability to be fully present with the speaker and be able to set aside one’s own thoughts and agenda.

Other

Once authentic trust and effective communication are in place, families can move forward as a more cohesive team to ensure other key components of successful wealth transition are in place. These include:

- Identifying family values

- Developing a written family wealth mission statement for how the wealth is to be used, today and in the future. To be successful, this statement must be agreed upon by all family members and shared with the family’s trusted advisors. The advisors, in turn, draft the estate documents to align with the family’s wealth mission.

- Identifying and planning for future family roles.

- Supporting the next generation to pursue their own ambition and purpose

Sounds easy enough, right? It’s not, and here’s why. Many families lack trust and find communicating effectively very challenging. Cordial hypocrisy is practiced in families that simply agree with the patriarch or matriarch to avoid disrupting the order even when they disagree. Members decide to agree and to get along until the wealth is transferred. Stories of families suing each other post-estate transfer are all too common, and sadly, preventable when breakdowns in trust and communication among family members are resolved in advance.

Families do Not Have to go it Alone—The Role of a Family Coach

Good news is that once families acknowledge a lack of preparation for successful wealth transfer beyond the financial assets—or suspect they should be doing more—resources are available. Successful families frequently engage the support of family coaches who specialize in wealth transfer planning and heir preparation that supports—and adds value to—the good work being done by legal/accounting/financial advisors.

One of the primary roles of a family coach it to encourage families to develop a strategic and tactical plan to ensure a successful wealth transition based on trust and communication.

The Williams Group is a family coaching firm, whose highly skilled coaches have years of experience coaching families to succeed in wealth transitions. Their professional backgrounds include psychology, estate planning, social work, conflict resolution, education, and communication. The Williams Group coaches are skilled in assisting with the breakdowns that occur within families and can support the family to learn new ways and use new tools to navigate challenging communication issues. They are dedicated to the best outcome for the family by building skills with family members in areas necessary for a successful transition of wealth.

Signs of a Well-Coached Family

A well-coached family is in a position to join the 30% of families whose unity and harmony—and financial assets—remain intact after wealth transition. A well-coached family has developed the communication skills needed to talk about issues important to the family, and enjoy a high degree of trust and personal care among family members. In addition, a well-coached family has a clear mission/purpose for the family wealth going forward and reflects the core values family members share. Family members are given the opportunity to express an interest in a family role that fits with the family mission. Perhaps most importantly, family members look to the family as a cohesive team and believe that the family itself, rather than its money, is the true measure of its wealth.

Amy Castoro is President and Senior Family Coach of The Williams Group (www.thewilliamsgroup.org). She co-authored the new book, Bridging Generations: Transitioning Family Wealth and Values for a Sustainable Legacy.

Amy Castoro is President and Senior Family Coach of The Williams Group (www.thewilliamsgroup.org). She co-authored the new book, Bridging Generations: Transitioning Family Wealth and Values for a Sustainable Legacy.