Understanding Retirement Readiness in America: How Do You Stack Up?

By Jim Poolman

According to the U.S. Census Bureau, all baby boomers will be older than 65 in 2030. While 12 years from now may seem far off, we are just a little over a decade away from living in a world where Americans, at or beyond retirement age, will drastically outnumber their children. When they do, how prepared will America’s workforce be to retire?

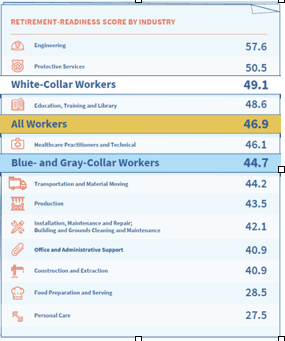

The Indexed Annuity Leadership Council (IALC) commissioned a recent study on The State of America’s Workforce: The Reality of Retirement Readiness to provide insight, and found industry and company size are two determining factors in retirement preparedness.

The Disparity Among Workers

The America’s workforce data showed eight of 11 blue- and gray-collar industries perform below the overall average for America’s workforce when comparing the retirement-readiness scores across occupational classifications. While Food Preparation and Serving, and Personal Care are the least prepared of all blue- and gray-collar industries, two blue- and gray-collar fields, Engineering and Protective Services, are outperforming all workers when it comes to retirement readiness.

Additionally, company size has a significant impact on the retirement readiness of America’s workforce: the larger the company size, the more employees feel informed about retirement planning and excited about their golden years.

Despite these gaps in readiness, today’s retirement landscape offers a variety of savings options for all workers to create their own retirement freedom. One of these retirement vehicles is a fixed indexed annuity (FIA), which works overtime to provide a lifetime income stream, while offering tax-deferred growth, and principal protection from market swings.

Overall Retirement Landscape is Shifting

While Americans are facing a changing retirement model, FIAs will help address many basic retirement concerns. This is important to keep in mind, as today’s reality of America’s workforce is working more and working longer:

- Almost four in 10 pre-retirees will likely work part time in their retirement years, either by choice or necessity.

- Three in five Americans are very likely to work longer than they’d like to meet their personal retirement goals.

- On average, American workers expect to push back retirement by two years.

The emerging “gig economy” helps to support this trend by offering a greater number of freelance and independent contractor positions. A portion of workers (nearly 14 percent) are taking on a “side hustle” with the explicit goal of saving for retirement. At the same time, only one in eight Americans have an employer-sponsored plan to help plan for their golden years.

Regardless of how the landscape is shifting and whether you are offered an employer-sponsored plan, IALC’s retirement-readiness research shows workers are, above all else, looking for lifetime income (nearly 80 percent).

A Deeper Dive on Fixed Indexed Annuities

Fixed indexed annuities can help guarantee a steady income stream for your whole retirement. At the same time, portfolio diversification helps manage risks and rewards in the financial market. FIAs are a great option to diversify, ensuring you are not putting all your eggs in one basket.

A financial professional, who is licensed to sell FIAs, is a great resource to help you decide if you should add one to your portfolio. The sooner you have the conversation the better for your retirement preparedness, but I recommend doing it before 2030 rolls around.

Jim Poolman serves as the Executive Director of the Indexed Annuity Leadership Council (IALC), a coalition of life insurance companies that have come together to increase the dialogue surrounding fixed indexed annuities (FIAs).

Category: Articles, Blog, Retirement Planning