COVID-19 Scams On The Rise: How To Protect You And Your Loved Ones

Author: Alice Rodriguez, financial health executive with JPMorgan Chase & Co.

Author: Alice Rodriguez, financial health executive with JPMorgan Chase & Co.

Millions of people fall victim to fraud each year and scammers pocket other people’s money by preying on fear, embarrassment and confusion. Between January 1, 2020 and April 15, 2020, the Federal Trade Commission (FTC) received 18,235 reports with Americans losing a combined $13.44 million related to COVID-19 fraud. The top complaint categories were fraud attempts related to travel, vacations, online shopping and even fake vaccinations.

To help protect you and your loved ones, there are a variety of online resources like these (hyperlinked) from AARP Foundation in collaboration with Chase to help older adults learn how to spot fraudulent activity, prevent scams and gain confidence with financial technology. The more skilled we become at spotting fraud, the better our defenses.

As social distancing continues to be recommended, more of us are using mobile apps, including financial technology, for daily activities. Banking online may be new to some, and that is why taking a safety-first approach is important for tackling everyday tasks while safeguarding your information.

Here are a few tips to help protect you and your loved ones from financial fraud during this time, as well as in the future:

Don’t Give Out Personal Information

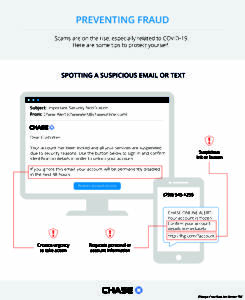

Scammers often present themselves as someone trustworthy, like a charity representative or government official. If you’re getting calls, emails or texts, keep in mind that the government will never call you out of the blue to ask for your personal information or money. Trustworthy organizations will never threaten you or force you into immediate action. Furthermore, financial institutions will never ask for confidential information such as your name, password, PIN and other account information when they reach out to you.

If someone you don’t know requests personal information over the phone, hang up. Look up the phone number online and call to see if you can independently confirm where the call is originating from. You also can use your phone features to block them from reaching you in the future. If you believe you have been contacted by scammers, report them. It only takes a few minutes to file a complaint with the FTC. You can also help protect yourself against potential phone scammers by signing up for The National Do Not Call Registry.

Check the Language Used

While “stimulus check” has been a commonly used term surrounding COVID-19 government relief checks, according to the IRS, its official term is “economic impact payment.” If you get a message referring to the “stimulus check” or “stimulus payment” it is a clear sign that the message is a scam. Always trust your instincts, if something doesn’t feel quite right, or too good to be true, it is likely to be a scam.

Set Alerts

Take advantage of accessible tools that can help you detect fraud and manage your account. For example, Chase offers 24-hour fraud monitoring with alerts for customers. Transaction alerts can help you protect your account. By setting up an alert every time there is a withdrawal from your savings or checking account, you are given a notification about your account activity and can confirm that the charge came from you. Not only will these alerts help you to spot financial fraud, but they will also help you better manage your finances and keep track of your spending habits

Be Wary of Phishing Fraud

The Justice Department has shut down hundreds of suspicious websites (many with terms such as “Coronavirus” and “COVID19” in the domain name) that are promising vaccines and other aid. These sites are often pretending to represent government agencies or humanitarian organizations and once you click on those malicious domains, you’ll likely start to receive phishing emails from fraudsters in an attempt to collect your personal information.

Be careful when you are browsing the web for information about COVID-19. Official information on vaccines and other forms of aid will come from a trustworthy source such as the U.S. Centers for Disease Control and Prevention (CDC) or the World Health Organization (WHO). Make sure you are going to the legitimate CDC and WHO websites with a “.gov” or “.int” address.

Scams Targeting Your Social Security Benefits

Despite local Social Security Administration (SSA) office closures in many areas, the SSA will not stop or decrease Social Security benefit payments due to the current pandemic. Scammers may mislead people into thinking they need to provide personal information or pay by gift card, wire transfer, internet currency or by mailing cash, to maintain regular benefit payments during this time. Keep in mind that any communication on the SSA suspending or decreasing your benefits due to the pandemic is a scam, regardless of whether you receive the message by text, letter, email or phone call.

While consumers are always subjected to potential fraud, we need to be on particularly high alert during the pandemic. Also, if you think you have fallen victim to a scam, never be embarrassed to report it or look for help. Always remember, if something doesn’t feel right to you, trust your gut!

Category: Blog