Ready To Be My Own Boss Leads In Guidant Financial’s Report On Baby Boomers in Business

More than half of all small business owners are age 50+

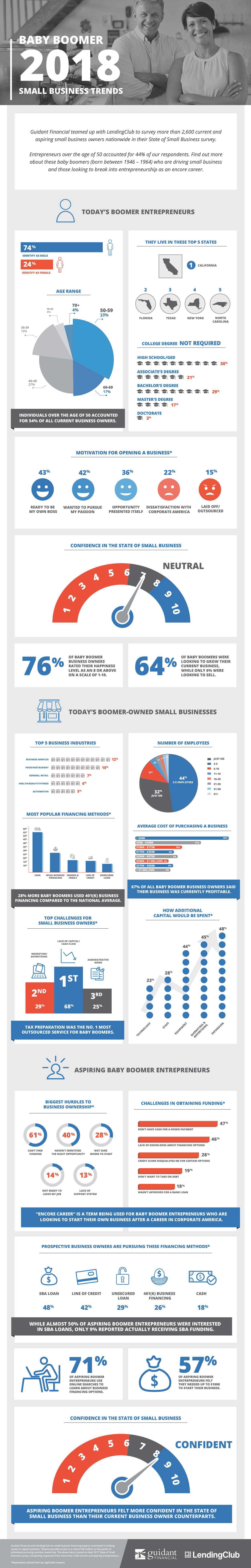

The world might be asking baby boomers about their retirement plans, but an increasing number of boomers are opting to start their own small businesses instead, according to a survey from small business financing company Guidant Financial. The company surveyed more than 2,600 small business owners and aspiring entrepreneurs nationwide and found 54 percent of business owners were over the age of 50, a 10 percent increase from the year before.

Highlighted findings in the Baby Boomer 2018 Small Business Trends survey include:

Trends

The survey also yielded valuable trend information on baby boomers in business. Highlights include:

- Demographics – 33 percent of all respondents were in their fifties, followed 17 percent in their sixties, and 4 percent at age 70 or above.

- Geography – California topped the list in terms of the highest volume of boomer entrepreneurs, followed by Florida, Texas, New York and North Carolina.

- Sector – The most popular business industries for baby boomers were business services, followed by food/restaurant, general retail, health/beauty/fitness and automotive.

Reason

Data showed that most baby boomers started businesses for positive reasons: “Ready to be my own boss” at 43 percent ranked as the top reason respondents over the age of 50 pursued business ownership, while “wanted to pursue my passion” at 42 percent nearly tied that choice. Thirty-six percent reported opportunity presented itself, 22 percent dissatisfied with corporate American and 15 percent laid off/outsourced.

Outlook

While the majority of boomer business owners rated their confidence in the political state of small business as neutral seven out of 10, 76 percent of these business owners rated their happiness level as an eight or above on a scale of 10. In fact, the majority of boomer business owners were trying to grow or expand their business, while only 6 percent were looking to sell. Trying to grow within any industry can be quite challenging. But when you finally get to see the results after everything you’ve worked for, it will all be worth it. As it is said one of the industries that baby boomers have taken an interest in is the food/hospitality industry, it may benefit you to look into something like restaurant POS review by RestaurantPOSSystems.com to help take your initial ideas of growing your business from being a dream into a reality.

Challenges

The survey also included those who have not yet started a business but hope to. The biggest hurdles among baby boomers looking to start a business were the inability to find funding (reported by nearly half the respondents) at 61 percent, not identifying the right opportunity and not being sure where to begin. Just under half 47 percent reported not having enough cash for a loan down payment, and about the same number reported a lack of knowledge about financing options as challenges to obtaining business funding.

Financing

Fifty-five percent of baby boomers typically fund their businesses using cash, followed by 25 percent using 401(k) business financing [formally known as Rollovers as Business Startups (ROBS)]. ROBS funding allows anyone with pre-tax retirement funds to fund a business using some or all of that money without incurring tax penalties. With the only requirement being a $50,000 minimum in a rollable retirement account, ROBS is often much easier funding to obtain without credit score or collateral requirements.

Of Interest: Baby boomers use ROBS financing at a rate that is 28 percent higher than the national average.

While lack of capital/cash flow remains a top challenge for boomer small business owners, 67 percent report that their business is currently profitable. More than two-thirds are also looking to grow their business while only 6 percent were trying to sell.

“Those who decide to start businesses later in life have several advantages over their younger counterparts,” said David Nilssen, CEO of Guidant Financial. “Baby boomers often have larger professional networks and years of business experience, and we’re seeing an increasing amount who are leveraging those benefits to launch and grow their own ventures.”

An accompanying infographic and more information can be found at https://www.guidantfinancial.com/learning-center/infographics/2018-baby-boomers-in-business/.

Methodology

Between November 28, 2017 and December 1, 2017, Guidant Financial conducted an email survey of more than 2,600 male and female small business owners and aspiring entrepreneurs from the continental U.S., Alaska, and Hawaii. Ages of respondents ranged from 18 to over 70.

Guidant Financial is a small business financing experts committed to making access to capital seamless. They’ve helped over 16,000 individuals secured over $4.2 billion in small business financing.

Category: Articles, Baby Boomer, Blog